Royal Unibrew Group

Investor Information

Royal Unibrew has published its Trading Statement for January 1 – September 30, 2025, on November 12, 2025.

The annual report for 2025 will be published on February 26, 2026.

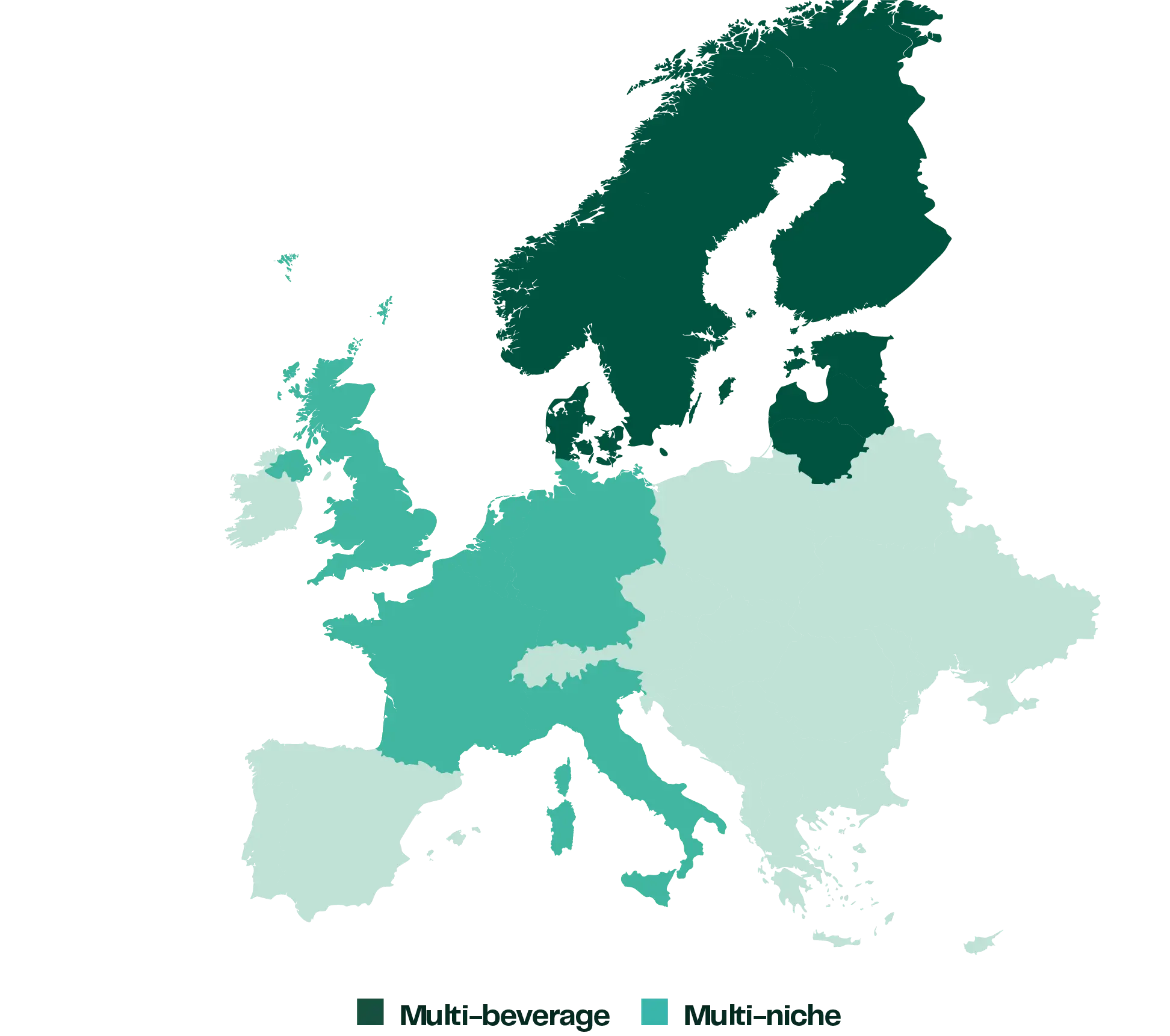

Our Multi-Beverage Portfolio

We offer a high-quality beverage portfolio that combines strong local heritage brands with leading international names. Our range spans both alcoholic and non-alcoholic categories, including no/low alcohol and no/low sugar alternatives.

Whether for everyday enjoyment or special occasions, our beverages are made to bring people together and create enjoyable moments.

Connect With Us

Follow us on LinkedIn for updates or sign up to receive our company announcements. Questions or inquiries? Get in touch through our contact page.